Is Equipment Deductible . Internal revenue code is an immediate expense deduction that business owners can take for purchases of depreciable. — the irs section 179 deduction lets business owners deduct the full amount of the cost of qualifying new and used machinery, furniture,. In 2024 (taxes filed in 2025),. — irs section 179 covers business deductions for equipment. — the section 179 deduction, combined with bonus depreciation, is a powerful tax break—enabling commercial businesses to write off the full cost of. — while business equipment, like other business property, must usually be depreciated, you may be able to deduct the full cost of business. section 179 of the u.s. Learn what equipment qualifies and how to claim the deduction on your. — section 179 of the internal revenue service tax code allows businesses of all types to deduct the full purchase price, up to $1,160,000 for qualifying.

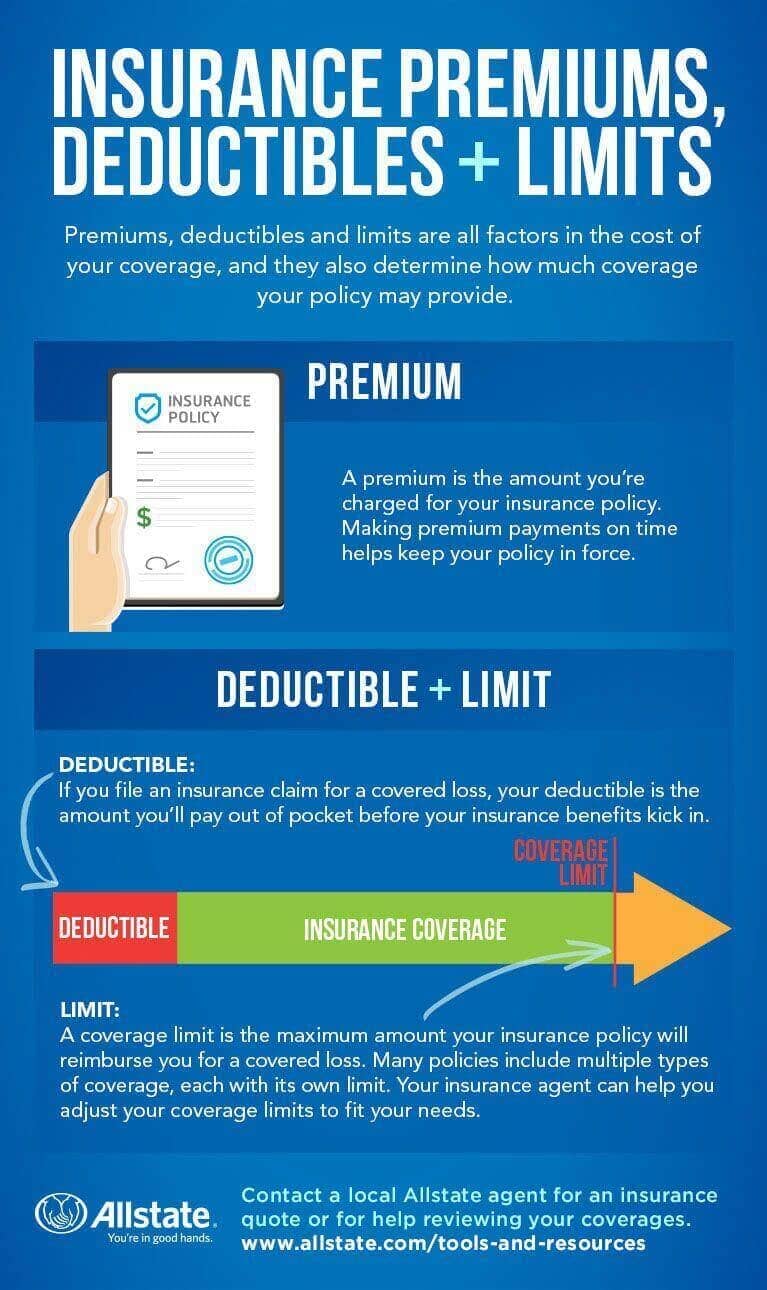

from www.allstate.com

section 179 of the u.s. — section 179 of the internal revenue service tax code allows businesses of all types to deduct the full purchase price, up to $1,160,000 for qualifying. — the section 179 deduction, combined with bonus depreciation, is a powerful tax break—enabling commercial businesses to write off the full cost of. In 2024 (taxes filed in 2025),. — the irs section 179 deduction lets business owners deduct the full amount of the cost of qualifying new and used machinery, furniture,. — irs section 179 covers business deductions for equipment. Internal revenue code is an immediate expense deduction that business owners can take for purchases of depreciable. Learn what equipment qualifies and how to claim the deduction on your. — while business equipment, like other business property, must usually be depreciated, you may be able to deduct the full cost of business.

Insurance Premiums, Limits and Deductibles Defined Allstate

Is Equipment Deductible Learn what equipment qualifies and how to claim the deduction on your. Internal revenue code is an immediate expense deduction that business owners can take for purchases of depreciable. In 2024 (taxes filed in 2025),. — the irs section 179 deduction lets business owners deduct the full amount of the cost of qualifying new and used machinery, furniture,. — while business equipment, like other business property, must usually be depreciated, you may be able to deduct the full cost of business. — section 179 of the internal revenue service tax code allows businesses of all types to deduct the full purchase price, up to $1,160,000 for qualifying. section 179 of the u.s. — irs section 179 covers business deductions for equipment. Learn what equipment qualifies and how to claim the deduction on your. — the section 179 deduction, combined with bonus depreciation, is a powerful tax break—enabling commercial businesses to write off the full cost of.

From www.practicaltaxplanning.com

COST OF EQUIPMENT FOR MEDICAL TREATMENT Eligible for Tax Deduction u/s. 80D? PRACTICAL TAX Is Equipment Deductible — while business equipment, like other business property, must usually be depreciated, you may be able to deduct the full cost of business. — the section 179 deduction, combined with bonus depreciation, is a powerful tax break—enabling commercial businesses to write off the full cost of. Learn what equipment qualifies and how to claim the deduction on your.. Is Equipment Deductible.

From www.retireguide.com

Medicare Part A & B Deductibles in 2023 Is Equipment Deductible Learn what equipment qualifies and how to claim the deduction on your. In 2024 (taxes filed in 2025),. — the irs section 179 deduction lets business owners deduct the full amount of the cost of qualifying new and used machinery, furniture,. — irs section 179 covers business deductions for equipment. section 179 of the u.s. —. Is Equipment Deductible.

From www.keylinadvisors.com

Is This Deductible? A Small Business Tax Deductions Checklist — KeyLin Is Equipment Deductible — irs section 179 covers business deductions for equipment. In 2024 (taxes filed in 2025),. Learn what equipment qualifies and how to claim the deduction on your. — while business equipment, like other business property, must usually be depreciated, you may be able to deduct the full cost of business. Internal revenue code is an immediate expense deduction. Is Equipment Deductible.

From www.bajajfinservhealth.in

Why is a deductible important in a health insurance policy? Is Equipment Deductible — the section 179 deduction, combined with bonus depreciation, is a powerful tax break—enabling commercial businesses to write off the full cost of. Internal revenue code is an immediate expense deduction that business owners can take for purchases of depreciable. In 2024 (taxes filed in 2025),. — the irs section 179 deduction lets business owners deduct the full. Is Equipment Deductible.

From www.lifeline.com

Are Medical Alert Devices Tax Deductible? Lifeline Is Equipment Deductible Learn what equipment qualifies and how to claim the deduction on your. — the section 179 deduction, combined with bonus depreciation, is a powerful tax break—enabling commercial businesses to write off the full cost of. — the irs section 179 deduction lets business owners deduct the full amount of the cost of qualifying new and used machinery, furniture,.. Is Equipment Deductible.

From www.youtube.com

What is a deductible and how does it work? YouTube Is Equipment Deductible — the section 179 deduction, combined with bonus depreciation, is a powerful tax break—enabling commercial businesses to write off the full cost of. — section 179 of the internal revenue service tax code allows businesses of all types to deduct the full purchase price, up to $1,160,000 for qualifying. — irs section 179 covers business deductions for. Is Equipment Deductible.

From www.blueridgeriskpartners.com

What are Deductibles? Blue Ridge Risk Partners Is Equipment Deductible — the section 179 deduction, combined with bonus depreciation, is a powerful tax break—enabling commercial businesses to write off the full cost of. section 179 of the u.s. — while business equipment, like other business property, must usually be depreciated, you may be able to deduct the full cost of business. — the irs section 179. Is Equipment Deductible.

From www.yourcaremedicalsupply.com

How to Use Your Deductible to Get New CPAP Supplies Is Equipment Deductible — the section 179 deduction, combined with bonus depreciation, is a powerful tax break—enabling commercial businesses to write off the full cost of. Internal revenue code is an immediate expense deduction that business owners can take for purchases of depreciable. — the irs section 179 deduction lets business owners deduct the full amount of the cost of qualifying. Is Equipment Deductible.

From dxojxpvsh.blob.core.windows.net

Exercise Equipment Tax Deductible at Christa Jordan blog Is Equipment Deductible In 2024 (taxes filed in 2025),. — section 179 of the internal revenue service tax code allows businesses of all types to deduct the full purchase price, up to $1,160,000 for qualifying. — the irs section 179 deduction lets business owners deduct the full amount of the cost of qualifying new and used machinery, furniture,. — the. Is Equipment Deductible.

From riskipa.com

What is Deductible Insurance? Riskipia Is Equipment Deductible — the section 179 deduction, combined with bonus depreciation, is a powerful tax break—enabling commercial businesses to write off the full cost of. — while business equipment, like other business property, must usually be depreciated, you may be able to deduct the full cost of business. In 2024 (taxes filed in 2025),. — the irs section 179. Is Equipment Deductible.

From www.klochko.com

Section 179 at a Glance for 2022 Equipment Savings Klochko Equipment Rental Company, Inc Is Equipment Deductible Learn what equipment qualifies and how to claim the deduction on your. — irs section 179 covers business deductions for equipment. Internal revenue code is an immediate expense deduction that business owners can take for purchases of depreciable. — the section 179 deduction, combined with bonus depreciation, is a powerful tax break—enabling commercial businesses to write off the. Is Equipment Deductible.

From www.youtube.com

Verify Is COVID19 protective equipment tax deductible? YouTube Is Equipment Deductible — the section 179 deduction, combined with bonus depreciation, is a powerful tax break—enabling commercial businesses to write off the full cost of. — section 179 of the internal revenue service tax code allows businesses of all types to deduct the full purchase price, up to $1,160,000 for qualifying. In 2024 (taxes filed in 2025),. — while. Is Equipment Deductible.

From www.ckitchen.com

IRS Section 179 Capital Equipment Deduction Blog Is Equipment Deductible Learn what equipment qualifies and how to claim the deduction on your. Internal revenue code is an immediate expense deduction that business owners can take for purchases of depreciable. — the section 179 deduction, combined with bonus depreciation, is a powerful tax break—enabling commercial businesses to write off the full cost of. — the irs section 179 deduction. Is Equipment Deductible.

From www.taxaudit.com

Is construction equipment deductible? Is Equipment Deductible — the irs section 179 deduction lets business owners deduct the full amount of the cost of qualifying new and used machinery, furniture,. Learn what equipment qualifies and how to claim the deduction on your. In 2024 (taxes filed in 2025),. section 179 of the u.s. — section 179 of the internal revenue service tax code allows. Is Equipment Deductible.

From invivowellness.com

What is the Difference Between a Health Insurance Deductible and a Copay for Physical Therapy Is Equipment Deductible — section 179 of the internal revenue service tax code allows businesses of all types to deduct the full purchase price, up to $1,160,000 for qualifying. — while business equipment, like other business property, must usually be depreciated, you may be able to deduct the full cost of business. Internal revenue code is an immediate expense deduction that. Is Equipment Deductible.

From www.financestrategists.com

Insurance Deductibles Definition, Types, & Factors to Consider Is Equipment Deductible — irs section 179 covers business deductions for equipment. — the section 179 deduction, combined with bonus depreciation, is a powerful tax break—enabling commercial businesses to write off the full cost of. — section 179 of the internal revenue service tax code allows businesses of all types to deduct the full purchase price, up to $1,160,000 for. Is Equipment Deductible.

From www.allstate.com

Insurance Premiums, Limits and Deductibles Defined Allstate Is Equipment Deductible — section 179 of the internal revenue service tax code allows businesses of all types to deduct the full purchase price, up to $1,160,000 for qualifying. — irs section 179 covers business deductions for equipment. Learn what equipment qualifies and how to claim the deduction on your. — the section 179 deduction, combined with bonus depreciation, is. Is Equipment Deductible.

From etrustedadvisor.com

Deductibles Explained eTrustedAdvisor Is Equipment Deductible — irs section 179 covers business deductions for equipment. section 179 of the u.s. In 2024 (taxes filed in 2025),. — section 179 of the internal revenue service tax code allows businesses of all types to deduct the full purchase price, up to $1,160,000 for qualifying. Learn what equipment qualifies and how to claim the deduction on. Is Equipment Deductible.